OFFICE OF THE CITY ASSESSOR

VISION

An office equipped with modern technology, managed by well disciplined, courteous, respectful and customer oriented friendly personnel maintaining the highest degree of professionalism and deep commitment in rendering prompt, efficient, effective and transparent real property assessment in pursuance of its goal of generating revenue to support development projects and basic services of the Talisaynons to improve their quality of life.

MISSION

- To discover, list, appraise and properly assess all real properties situated within the jurisdiction of the City of Talisay, Cebu in accordance with existing assessment rules and regulations in order to generate more income for the city.

- To maintain a systematic and effective accounting and inventory of all real property units within Talisay through graphics and electronic methods.

- To provide the taxpayers and the citizens of the City of Talisay, Cebu in general, with friendly, prompt, efficient and courteous public service at all times.

- To provide the employees of the Office with proper training and opportunity to improve their capabilities both mentally and physically so as to enhance their job performance effectiveness.

Objective:

1. Establish and implement a systematic method of Real Property Assessment.

2. Maintain and upgrade archival records of tax/base maps, copies of the deed of conveyance and other pertinent documents in support of tax declaration issuances.

3. List, appraise and evaluate real properties intelligently, fairly and uniformly to maintain the full confidence of real property owners and raise income.

4. Implement conscientiously the guidelines issued by the Bureau of Local Government Finance (BLGF) of the Department of Finance in the assessment and valuation of real properties pursuant to the provisions of RA 7160.

DUTIES AND FUNCTIONS

City Assessor

CARMELA A. CABRIANA, REA

The City Assessor performs all the functions described under BP Blg. 337, P.D. #464 & R.A. 7160, as amended and is responsible in the preparation, implementation of the plans and programs of the office, based on the objectives, guidelines, and system issued by the Department of Finance, its regional offices and the local government itself. He/She exercises direct supervision and control over the staff assigned at his/her office, and exercises such other powers and performs such other duties and functions as may be prescribed by law or ordinance.

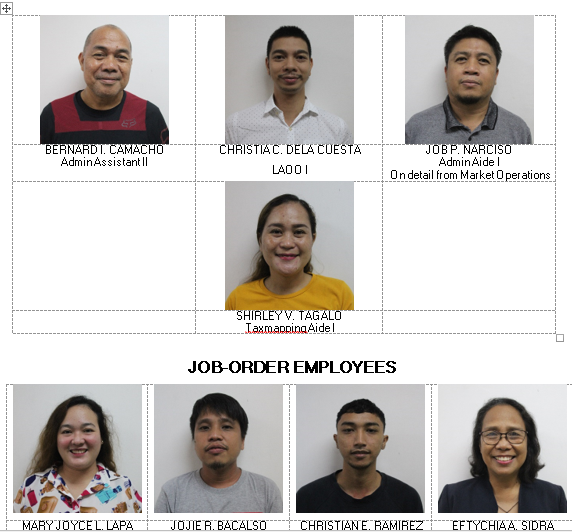

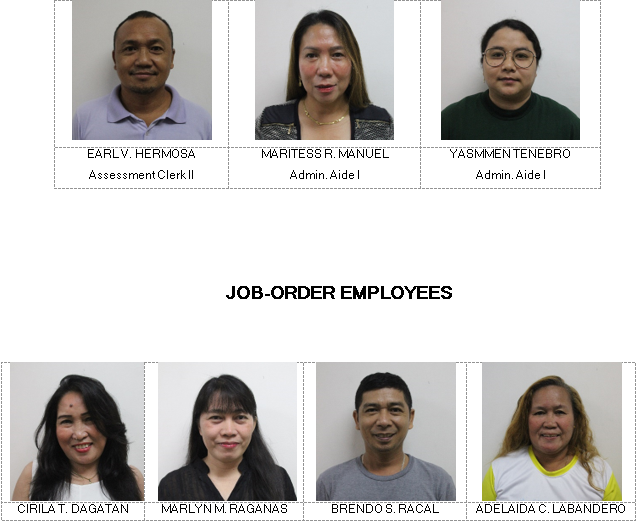

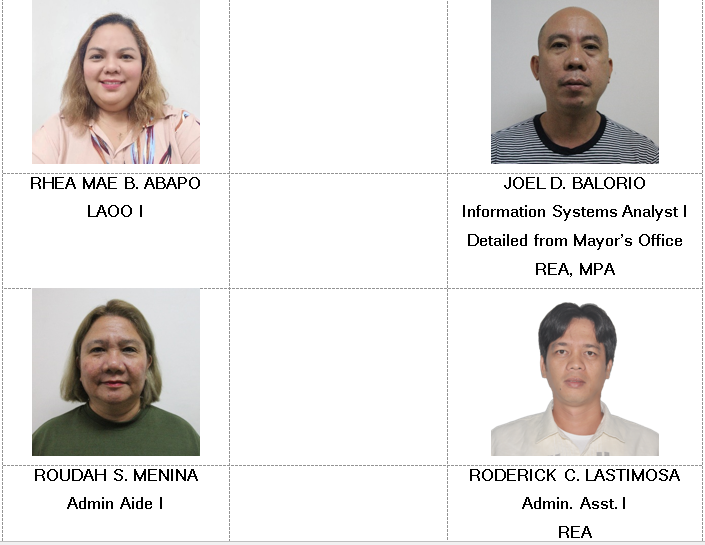

REGULAR EMPLOYEES

Duties and Functions:

1. Receives all incoming official communications, assigns them to the proper section/division concerned and releases through mail or other means of dispatching all outgoing communications.

2. Establish proper filing methods, classification of records & proper storage of records.

3. Acts as custodian of all office supplies, equipment & furniture.

4. Compiles all circulars and administrative issuances.

5. Type reports.

6. Procurement & Allocation of supplies, materials & equipment

7. Suggest/Recommend upgrading of position of employee/s to the City Assessor for recommendation to the LGE through the HR department.

8. Prepare payroll, PR/P.O./R.O.A.

9. Issue upon request of the declared owner or his/her authorized representative certified copies of all assessment records, certifications (property holdings, no improvements) and other related documents upon payment of prescribed fees based on the standing policies of the office pertaining to this matter.

10. Assist the City Assessor in the implementation of policies within the office.

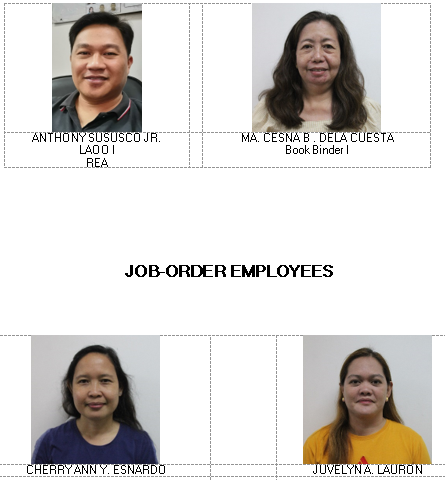

REGULAR EMPLOYEES

Duties and Functions:

1. Conduct ocular inspection on all real properties for assessment purposes.

2. Appraise all real property at current market value and apply uniformly the assessment level in accordance with the law.

3. Prepares FAAS and tax declarations for all existing and newly declared properties (land, buildings, machinery, etc.).

4. Prepares all transfers and cancellations based on supporting documents presented by the taxpayers, subject to the signature of the City Assessor for approval.

5. Updating of assessment of machinery by asking for their current prices at hardware stores & other business establishments which sells or produces such machinery.

6. Computes market values and assessed values of certain properties based on the approved Schedule of Market Values.

7. Compute transfer tax.

8. Keep a record of all transfers, leases and mortgages of real property, rentals, insurance and cost of construction of buildings and other improvements on land for assessment purposes.

9. Coordinate wit Tax mapping Division and Records Division.

10. Performs all other functions in connection with appraisal and assessment.

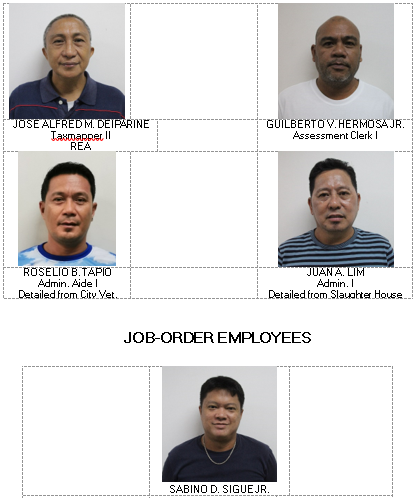

REGULAR EMPLOYEES

Duties and Functions:

1. Makes requests, through the City Assessor for base maps, technical descriptions and approved subdivision plans from the CENRO.

2. Updates base maps for each barangay.

3. Prepares Pre-TMCR and update post TMCR and all other tax mapping records.

4. Conduct field inspection with the City Assessor for identification of proper location, ownership, and discovery of new undeclared lots.

5. Prepares Index Maps (City, Barangay & Section).

6. Assigns PIN’s (property index numbers) to each property.

7. Updates & maintains all tax mapping records.

8. Acts as custodian of all tax mapping records.

9. Issues extracts and/or certified copies of plans and other tax mapping records.

10. Coordinate with Appraisal & Assessment Division and Records Division on matters relative to assessment & tax mapping.

REGULAR EMPLOYEES

Duties and Functions:

1. Prepares and issue certified and certifications of assessment records and other related documents per request of the taxpayer upon payment of prescribed fees.

2. Acts as custodian of all assessment records, such as tax declarations, forms, assessment rolls, FAAS, ownership record form, and all supporting documents.

3. Releases owner’s copy of TD’s and other assessment records to the owner.

4. Updating of all assessment records such as tax declarations, assessment rolls, FAAS, ORF, and all other assessment forms.

5. Keep a correct record of all transfers, leases, and mortgages of real property, rentals, insurance, and cost of construction of buildings and other improvements on land for assessment purposes.

6. Performs all other duties and functions in connection with records maintenance and management.

REGULAR EMPLOYEES

Duties and Functions:

Encoding of all entries in the file of TD’s.

1. Enter inventory of all properties in the computer based on lot numbers, TD’s owners & location.

2. Issuance of Notice of Assessment.

3. Issuance of certifications (property holdings, no improvements, etc.).

4. Keeps online with the Treasurer’s Office, entries in the Assessment Roll.

5. Encoding and printing of some documents needed in the assessment.

6. Printing vital information needed for certain property or owner.

7. Conduct computation of Market Values & Assessed Values of all real properties for General Revision of Valuation and other Special Projects entered into by the LGU for RPTA.

8. In charge of the conduct and application of the programs & systems as a result of the computerization project.

9. Performs all other functions in connection with encoding & automation of real property records

The City Assessor’s Office inspired by its vision aims to be an office of better job performance, effectiveness and a high degree of professionalism staffed by friendly, courteous and dedicated employees.

The function of the City Assessor is generating more revenues from the Real Properties within the City of Talisay through:

• Discovering, appraising and assessing real properties

• Tax mapping and real property accounting and inventory

in connection to this, the Office transfers tax declarations for taxation purposes from one owner to another in order to identify who is liable in paying the real property tax. It also issues different certification pertaining to real properties.

On the aspect of generating more income for the City through increased real property assessment, the office can present an impressive discovery and assessment records while showing a dramatic and sustained increase in assessment.

Different strategies used in the accounting, inventory, and updating of classification and valuation:

• Tax Mapping –This pertains to the inventory and accounting of real properties in the field in connection with the records in the office.

• General Revision – This is mandated as stipulated in Section 219, Book II of RA 7160 or the Local Government Code of 1991. It states that a general revision of classification should be done two (2) years after the activity of the Code and every three (3) years thereafter.

The Schedule of Market Values for the City of Talisay was approved through City Ordinance No. 09-(S.2019) on November 5, 2019 with the effectivity of the taxes in 2020

The office continues to deal on the regular transactions, discovering new real properties most especially buildings, machinery, and other structures.

At present, the Office is using the Integrated Management System from Cylix Technologies Inc. for its daily transaction.

Tax rates imposed is two percent (2%), one percent (1%) for Basic Tax and another one percent (1%) for Special Education Fund (SEF).

Assessor’s Office Tel. No.

273-1677

491-3898

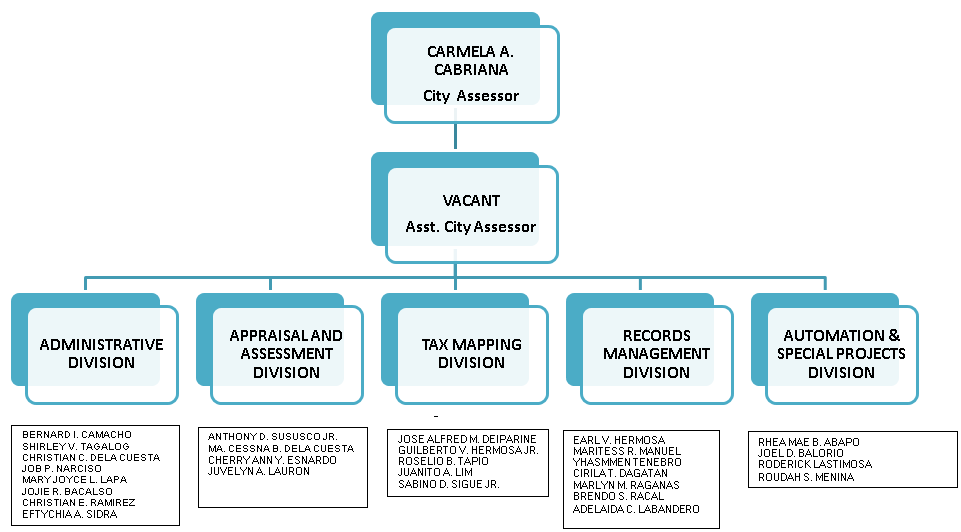

ORGANIZATIONAL CHART